Laser Cutting Machines on Installments Explained: Learn About Financing Options

Purchasing laser cutting equipment represents a significant investment for businesses and entrepreneurs. Understanding installment plans and various financing options can make this advanced technology more accessible. From traditional loans to equipment leasing, multiple pathways exist to acquire laser cutting machines without overwhelming upfront costs, enabling businesses to grow while managing cash flow effectively.

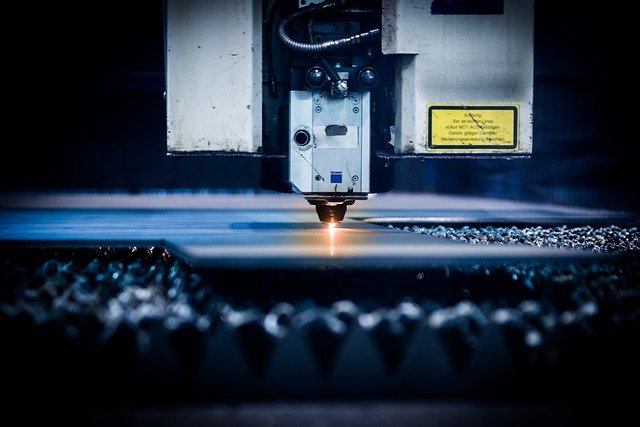

Laser cutting technology has revolutionized manufacturing, crafting, and prototyping across numerous industries. However, the substantial upfront investment required for quality laser cutting equipment often creates barriers for small businesses, startups, and individual entrepreneurs. Financing options have emerged as practical solutions, making this powerful technology accessible through manageable payment structures.

What Does Laser Cutting Machines on Installments Mean?

Installment purchasing for laser cutting machines involves spreading the total equipment cost across multiple scheduled payments over a predetermined period. Instead of paying the full amount upfront, buyers make regular monthly or quarterly payments until the machine is completely paid off. This approach allows businesses to acquire necessary equipment while preserving working capital for other operational needs.

Installment plans typically include the principal amount plus interest charges, with terms ranging from 12 months to several years depending on the equipment value and lender requirements. Many suppliers offer direct financing options, while others partner with financial institutions to provide competitive rates and flexible terms.

What Other Financing Options Are There?

Beyond traditional installment plans, several financing alternatives exist for laser cutting equipment acquisition. Equipment leasing represents a popular option where businesses pay monthly fees to use the machine without ownership, often including maintenance and upgrade provisions.

Business loans from banks or credit unions provide another pathway, offering lump-sum funding to purchase equipment outright. These loans may feature lower interest rates than supplier financing but require stronger credit profiles and collateral.

Equipment financing specifically designed for machinery purchases often provides competitive rates and terms tailored to the equipment’s expected lifespan. Some programs offer seasonal payment structures or deferred payment options to accommodate business cash flow patterns.

Government-backed loans, grants, and small business administration programs may also provide funding opportunities for qualifying businesses, particularly those in manufacturing or technology sectors.

What Is The Difference Between The Different Financing Options?

Each financing method offers distinct advantages and considerations. Installment purchases lead to equipment ownership upon completion of payments, building business assets and providing long-term value. However, they typically require higher monthly payments compared to leasing options.

Leasing arrangements offer lower monthly costs and often include maintenance coverage, but businesses never gain ownership equity. At lease end, companies must return equipment, purchase it at residual value, or negotiate new lease terms.

Traditional business loans provide immediate ownership and potentially lower overall costs but require strong creditworthiness and may demand personal guarantees or collateral. The application process can be lengthy and documentation requirements extensive.

Equipment-specific financing often features streamlined approval processes and competitive rates since the equipment itself serves as collateral. These programs frequently offer flexible terms and may include trade-in provisions for future upgrades.

| Financing Type | Provider Examples | Typical Terms | Cost Estimation |

|---|---|---|---|

| Equipment Financing | Balboa Capital, TimePayment | 2-7 years | 8-25% APR |

| Business Loans | Wells Fargo, Bank of America | 1-10 years | 6-18% APR |

| Equipment Leasing | DLL Financial, GreatAmerica | 2-5 years | $50-200/month per $10K |

| Supplier Financing | Boss Laser, Epilog | 1-5 years | 0-24% APR |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

The choice between financing options depends on factors including credit profile, cash flow requirements, tax considerations, and long-term business plans. Ownership-focused businesses often prefer installment purchases or loans, while companies prioritizing cash flow flexibility may favor leasing arrangements.

Tax implications also vary significantly between options. Purchased equipment may qualify for depreciation deductions and potential tax credits, while lease payments are typically fully deductible as business expenses. Consulting with financial advisors and tax professionals helps determine the most advantageous approach for specific situations.

Financing laser cutting equipment opens opportunities for businesses to access advanced manufacturing capabilities without depleting working capital. Understanding available options, comparing terms, and evaluating long-term implications enables informed decisions that support business growth and operational efficiency. Whether through installments, leasing, or traditional loans, multiple pathways exist to make laser cutting technology accessible and affordable for diverse business needs.