Car Dealership Services and Vehicle Solutions Explained

Car dealerships do more than sell vehicles: they manage inventory, arrange financing, process trade-ins, and support owners after the sale. Understanding how these services fit together can help you compare options, prepare documents, and make clearer decisions when choosing between new and pre-owned vehicles.

Buying or servicing a vehicle often involves several moving parts—selection, paperwork, financing, and ongoing support. A car dealership brings these steps together in one place, coordinating vehicle inventory, trained staff, and third-party partners so customers can research, test, purchase, and maintain a vehicle with fewer handoffs. Understanding what happens behind the scenes can also make the process feel more predictable.

Understanding How a Car Dealership Operates

Most dealerships are structured around a few core functions: vehicle acquisition, sales, finance and insurance (often called F&I), and service/parts. Inventory is sourced through manufacturers (for new vehicles), auctions and trade-ins (for pre-owned vehicles), and dealer-to-dealer transfers. Each channel affects availability, vehicle history documentation, and how quickly a specific trim or configuration can be located.

Operationally, inventory management is a constant balancing act. Dealerships track demand by model, price band, fuel type, and features, while also considering storage capacity and how long a car sits before being sold. Customer support services typically include product education, appointment scheduling, recall checks, and coordination with service departments—especially important when questions arise about warranties, maintenance intervals, or software updates.

New and Pre-Owned Vehicle Options

New and pre-owned vehicle options differ in more than mileage. New vehicles generally offer the newest safety and infotainment features, predictable ownership history, and manufacturer warranty coverage from day one. Pre-owned vehicles may provide more choice at a given budget, including discontinued models or higher trims that would cost more new. However, pre-owned purchases benefit from closer attention to service records, ownership history reports (where available), and a clear understanding of remaining warranty or certified coverage terms.

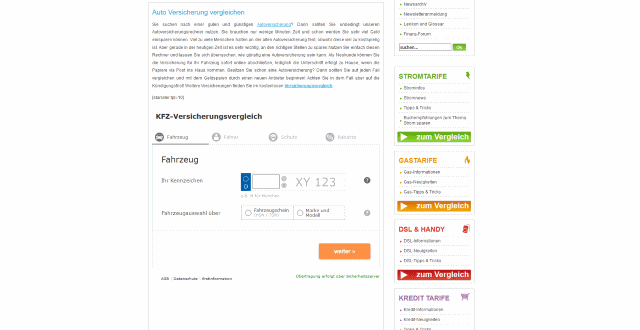

Financing solutions and trade-in opportunities are often central to the decision. Financing can be arranged through a manufacturer’s finance arm, a bank, or a credit union, and the best fit depends on credit profile, term length, and local regulations. Trade-ins reduce the amount financed, but the net benefit depends on how the trade-in value compares with any discounts, fees, and taxes. In many regions, tax rules also influence whether trading in at the point of purchase changes the taxable amount.

Real-world pricing is typically shaped by more than the sticker price. Common cost components include taxes, registration, destination or delivery charges (especially on new vehicles), documentation fees (where permitted), optional add-ons, and interest paid over time if financing is used. As a practical benchmark, advertised auto loan APRs in many mature markets can range roughly from the mid-single digits to the mid-teens depending on credit, term, and lender policy, while dealer documentation fees and registration-related charges can range from modest to substantial depending on jurisdiction.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Captive auto financing | Toyota Financial Services | Typical advertised APR range varies widely by market and credit; often mid-single digits to mid-teens |

| Captive auto financing | Ford Credit | Typical advertised APR range varies widely by market and credit; often mid-single digits to mid-teens |

| Indirect auto lending (via dealerships) | Ally Auto | Typical APR range varies widely by credit and term; often mid-single digits to mid-teens |

| Direct-to-consumer auto loans | Capital One Auto Finance | Typical APR range varies widely by credit and term; often mid-single digits to mid-teens |

| Bank auto loans | Bank of America Auto Loans | Typical APR range varies widely by credit and term; often mid-single digits to mid-teens |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

What to Expect When Visiting a Car Dealership

A productive visit usually starts with clarity on needs and constraints: vehicle size, usage pattern, fuel or charging access, must-have safety features, and a realistic budget that includes taxes and fees. Test drives are typically designed to verify comfort, visibility, braking feel, and real-world usability (parking, cabin noise, and controls). If comparing multiple vehicles, using the same route and conditions can make differences easier to notice.

Documentation procedures vary by country, but commonly include identity verification, address confirmation, driver’s license checks for test drives, and signed purchase agreements. For financing, expect income and employment verification requirements in many regions, plus a credit check where legally applicable. For a trade-in, dealerships commonly inspect condition, tires, service history, and any accident repairs. Having maintenance records and being transparent about known issues tends to reduce surprises during appraisal.

After-sales support is a major part of dealership services. This can include scheduled maintenance, warranty repairs, software updates, recall handling, and parts availability. It may also include extended warranty products or service plans, which differ significantly by coverage details, exclusions, and claim process. Asking how service bookings work, what turnaround times look like for common repairs, and how warranty authorization is handled can clarify what ownership will feel like after the purchase.

A car dealership can be thought of as a hub that connects vehicle selection, financing, and long-term ownership support. By understanding how inventory and sales processes work, how new and pre-owned vehicle options differ, and what to expect during visits and paperwork, you can compare choices more consistently and reduce uncertainty—especially around the full, all-in cost of owning the vehicle over time.